It’s important to note that the FIFO method is designed for inventory accounting purposes. In many cases, the inventory that’s received first shark tank isn’t always necessarily sold and fulfilled first. Now that we have ending inventory units, we need to place a value based on the FIFO rule.

What is FIFO? First In, First Out Method Explained

To calculate the value of ending inventory, a brand uses the cost of goods sold (COGS) of the oldest inventory, despite any recent changes in costs. On the basis of FIFO, we have assumed that the guitar purchased in January was sold first. The remaining two guitars acquired in February and March are assumed to be unsold. Because the value of ending inventory is based on the most recent purchases, a jump in the cost of buying is reflected in the ending inventory rather than the cost of goods sold. In a period of inflation, the cost of ending inventory decreases under the FIFO method. Therefore, the value of ending inventory is $92 (23 units x $4), which is the same amount we calculated using the perpetual method.

FIFO method: Pros vs. Cons

The FIFO method impacts how a brand calculates their COGS and ending inventory value, both of which are always included on a brand’s balance sheet at the end of a financial accounting period. On the third day, we assign the cost of the three units sold as $5 each. This is because even though we acquired 30 units at the cost of $4 each the same day, we have assumed that the sales have been made from the inventory units that were acquired earlier for $5 each. First-in, first-out (FIFO) is one of the methods we can use to place a value on the ending inventory and the cost of inventory sold. If we apply the FIFO method in the above example, we will assume that the calculator unit that is first acquired (first-in) by the business for $3 will be issued first (first-out) to its customers. By the same assumption, the ending inventory value will be the cost of the most recent purchase ($4).

What Is the FIFO Inventory Method? First-In, First-Out Explained

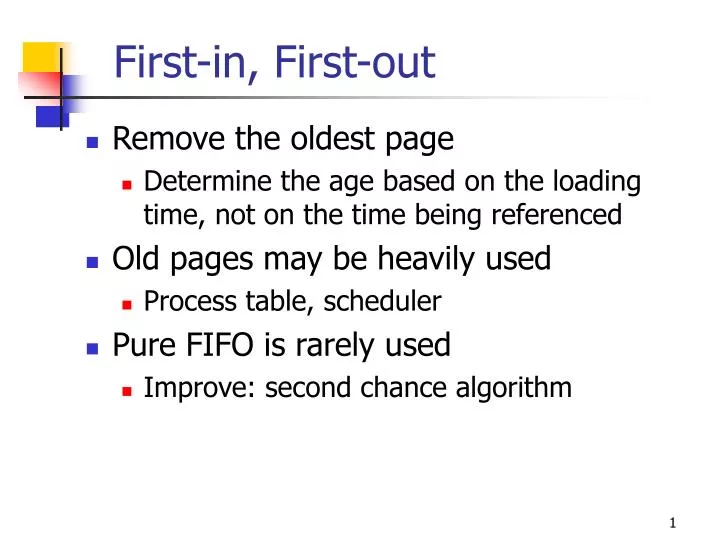

Both approaches tend to generate similar values unless there is a substantial change in the price of inventory during the accounting period. First-In, First-Out (FIFO) is one of the methods commonly used to estimate the value of inventory on hand at the end of an accounting period and the cost of goods sold during the period. This method assumes that inventory purchased or manufactured first is sold first and newer inventory remains unsold. Thus cost of older inventory is assigned to cost of goods sold and that of newer inventory is assigned to ending inventory. The actual flow of inventory may not exactly match the first-in, first-out pattern. The reverse approach to inventory valuation is the LIFO method, where the items most recently added to inventory are assumed to have been used first.

- Learn more about what types of businesses use FIFO, real-life examples of FIFO, and the relevance of FIFO with frequently asked questions about the FIFO method.

- The price on those shirts has increased to $6 per shirt, creating another $300 of inventory for the additional 50 shirts.

- With FIFO, it is assumed that the cost of inventory that was purchased first will be recognized first.

- FIFO has several advantages, including being straightforward, intuitive, and reflects the real flow of inventory in most business practices.

- When it comes down to it, the FIFO method is primarily a technique for figuring out your cost of goods sold (COGS).

Yes, ShipBob’s lot tracking system is designed to always ship lot items with the closest expiration date and separate out items of the same SKU with a different lot number. ShipBob is able to identify inventory locations that contain items with an expiry date first and always ship the nearest expiring lot date first. If you have items that do not have a lot date and some that do, we will ship those with a lot date first.

What is the biggest con of using the FIFO method?

For example, FIFO can cause major accounting discrepancies when COGS increases significantly. If accountants use a COGS calculation from months or years back, but the acquisition cost of that inventory has tripled in the time since, profits will take a hit. While it’s useful to have a basic understanding of how to use the FIFO inventory method, we strongly recommend using accounting software like QuickBooks Online Plus. It’ll do all of the tedious calculations for you in the background automatically in real time.

In fact, it’s the only method used in many accounting software systems. There are balance sheet implications between these two valuation methods. More expensive inventory items are usually sold under LIFO so the more expensive inventory items are kept as inventory on the balance sheet under FIFO. Not only is net income often higher under FIFO but inventory is often larger as well. How does a company determine the amount by which to reduce inventory and income? Because the price the company paid to wholesalers might change with each order, the COGS also changes with each sale.

FIFO is popular among companies because it simplifies tracking the flow of costs—the goods purchased first are the ones sold first. FIFO is the best method to use for accounting for your inventory because it is easy to use and will help your profits look the best if you’re looking to impress investors or potential buyers. It’s also the most widely used method, making the calculations easy to perform with support from automated solutions such as accounting software.

This approach is useful in an inflationary environment, where the most recently-purchased higher-cost items are removed from the cost layering first, while older, lower-cost items are retained in inventory. This means that the ending inventory balance tends to be lower, while the cost of goods sold is increased, resulting in lower taxable profits. FIFO, or First In, First Out, is a method of inventory valuation that businesses use to calculate the cost of goods sold.

Under the moving average method, COGS and ending inventory value are calculated using the average inventory value per unit, taking all unit amounts and their prices into account. Rather, every unit of inventory is assigned a value that corresponds to the price at which it was purchased from the supplier or manufacturer at a specific point in time. Due to inflation over time, inventory acquired more recently typically costs more than older inventory. With the FIFO method, since the older goods of lower value are sold first, the ending inventory tends to be worth a greater value.

For example, using its inventory management tool, you can view which orders are committed/allocated against a particular SKU and/or warehouse. Whether you’re using FIFO, LIFO, accurate cost, or some other inventory management method, Extensiv can help you streamline and optimize inventory management, warehousing, and shipping processes. Determining which stock management method best suits your business depends on several factors.